Fed’s Annual Jackson Hole Summit – Upcoming Rate Cuts

“‘Inflation has declined significantly,’ Powell said. ‘The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized. And the balance of the risks to our two mandates has changed.’”Powell also emphasized that “the direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” However, he remained vague about the exact timing and extent of a potential cut. (NBC)

The takeaway here is that the Fed is taking a careful approach to managing the economy as it navigates through the recovery. While Powell notes the improvements in inflation and the labor market, he’s also making it clear that any future rate cuts will be cautious and data-driven. So, even though the market might expect lower rates soon, the exact timing and size of these cuts are still up in the air, leaving market participants to watch closely for any further signals from the Fed.

U.S. and Gold Markets Hold Strong

The U.S. stock market continued its resilient rebound, with the S&P 500 closing up another 1.2% last week. This upward momentum brought us to just over 1% shy of new all-time highs, reflecting strong market confidence. Investor optimism was evident as key sectors drove performance, steadily pushing the market toward record levels.

XAUUSD remained near its all-time highs, showing strength and market acceptance at these prices. The key levels we identified in last week’s outlook have held firm, serving as solid support and offered strategic entry opportunities for buyers.

What’s On Our Radar This Week

With the market seemingly showing no signs of weakness and once again nearing all-time highs, traders are developing an appetite for risk-on behavior. Positive economic indicators and anticipation surrounding upcoming data releases, such as Prelim GDP q/q, Unemployment Claims, and CB Consumer Confidence, is contributing to the optimistic outlook. The main concern is whether this bullish sentiment will sustain the rally or if greed will push the market into an overextended, vulnerable state.

As we head into this week, these are the levels we will be watching:

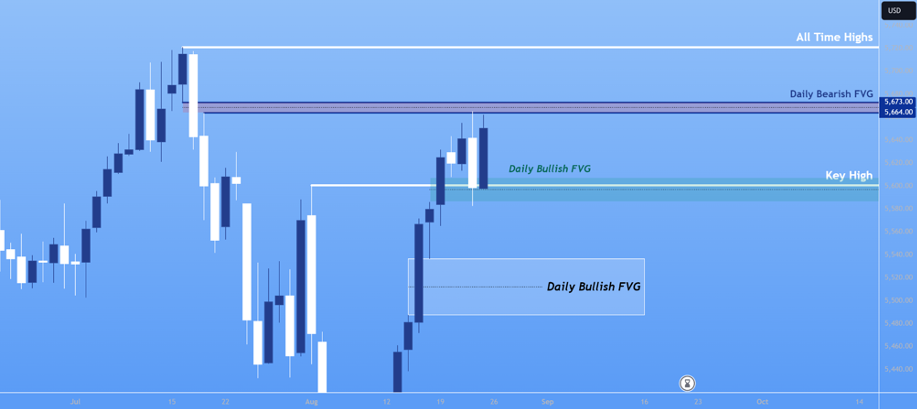

S&P 500

The S&P is gaining bullish momentum, turning old resistance into new support. However, it’s important to note that last week’s high was created after price tapped into a bearish FVG and sold off, signaling a sensitive area. Given the current structure, it looks like the price is set to break that high, but a deeper pullback to discount wouldn’t be surprising.

XAUUSD

Gold successfully retested and respected the levels we highlighted in last week’s outlook, showing acceptance above the $2500 mark and closing just under 1% from new all-time highs. This week, our focus remains on these levels as we watch for gold to form a higher high and higher low, preserving its bullish market structure.

EURUSD

With the Dollar continuing to weaken and EUR/USD rapidly climbing, we are now approaching last year’s high, a significant liquidity level. A successful retest could set the stage for the next major swing in the months ahead. We’ll be closely monitoring the market’s reaction to last week’s broken resistance to see if it drives us toward this key level.