Reflecting On Last Week

U.S. Indices Break New Highs

The Dow closed 522 points, or 1.3%, higher, reaching a new record after passing the 42,000 level for the first time. The S&P 500 rose 1.7%, topping 5,700 for the first time and also closing at a fresh high. (CNN)

Powell: Fed’s Rate Cut is a “Recalibration”

“We made a good strong start, and I am very pleased that we did,” Powell said, having reduced the benchmark policy rate by 50 basis points to 4.75%-5.00%. He described the move as a “recalibration” to account for the sharp decline in inflation. (WEF)

The Week Ahead: Events to Watch

All eyes will be on the PCE inflation report. Both headline PCE and core PCE price indexes are expected to rise by 0.2%, matching the previous month. Personal income is forecasted to have increased by 0.4%, slightly higher than the previous 0.3%, while consumer spending likely grew at a slower pace of 0.3%. The S&P Global flash PMIs are anticipated to show the manufacturing sector contracted at a slightly slower pace while the services growth eased.Traders will be focused on appearances by several officials, including Chair Powell and Treasury Secretary Yellen at the 2024 Treasury Market Conference hosted by the Federal Reserve Bank of NY. Other key indicators to watch include final GDP growth figures for Q2, durable goods orders, CB Consumer Confidence, regional PMIs including the Chicago Fed National Activity Index, the Richmond Fed Manufacturing Index, the Kansas Fed Manufacturing Index, the FHFA housing index and the S&P/Case-Shiller Home Price Index, new and pending home sales, and the final figures for the Michigan consumer sentiment. (TradingEconomics)

Levels On Our Radar This Week

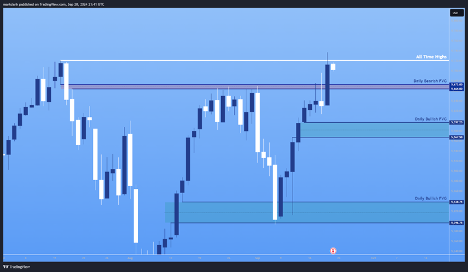

S&P 500

The S&P has traded above its all-time high but failed to close above it, so it can’t yet be considered a confirmed breakout. However, with a close above the resistance daily bearish FVG and a new higher high in the market structure, we can anticipate that previous highs will now serve as support.

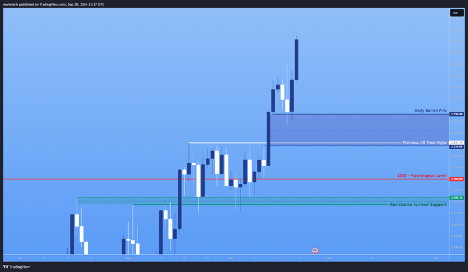

XAUUSD

Gold has respected the key level we pointed out last week and is now on a strong upward leg up. The question now is, how high can it go? With momentum building and resistance levels out of the way, there’s a good chance we could see more gains if conditions stay favorable.

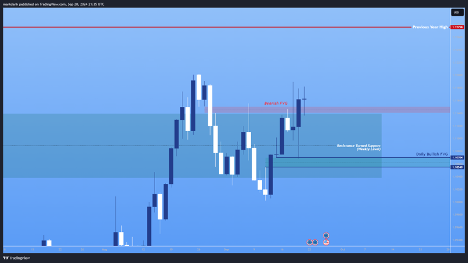

EURUSD

The EUR/USD tapped perfectly into the daily bullish FVG level we highlighted last week, aligning with the long bias we’ve maintained. Now, with a close above the daily bearish FVG, and if conditions remain favorable, we could see a breakout toward the previous yearly high. The setup continues to support further bullish momentum.