Reflecting On Last Week

U.S. Labor Market Surprises with 254K New Jobs in September

The U.S. job market posted stronger-than-expected results in September, with nonfarm payrolls increasing by 254,000—well above the anticipated 150,000. The unemployment rate fell to 4.1%, while average hourly earnings rose 0.4% for the month, bringing year-over-year wage growth to 4%, both exceeding forecasts. The robust job growth and wage gains indicate ongoing economic strength, which could influence the Federal Reserve’s future decisions on inflation and interest rates. (CNBC)

Three-Day Port Strike Concludes, Wage Deal Reached Amid $1 Billion Impact

The three-day strike at U.S. East and Gulf Coast ports ended after a wage agreement was reached between the Longshoremen’s Union and the U.S. Maritime Alliance. With an estimated $1 billion in losses at the Port Authority of New York and New Jersey alone, ports are now focused on clearing the significant backlogs left by the shutdown. The tentative deal includes a $4 per hour wage increase, though final ratification is still pending. (CNN)

Oil Prices Surge Amid Rising Iran-Israel Conflict

Oil futures surged nearly 5% this week, fueled by escalating tensions in the Middle East after Iran launched missile strikes on Israel. The conflict has raised concerns about potential disruptions to global crude supplies. Iran is the seventh-largest oil producer globally, accounting for nearly 5% of total output, so any disruption to its production could have widespread effects on global energy markets and fuel prices. (Forbes)

The Week Ahead: Events to Watch

In the U.S., this week’s focus will be on key economic reports such as CPI figures, FOMC minutes, and the start of earnings season. Annual inflation is expected to slow to 2.3% in September, marking its lowest level since February 2021. Traders will also be watching the PPI, Michigan consumer sentiment, trade balance, and the NFIB Business Optimism Index. The FOMC minutes may provide insight into the Fed’s next rate decision, especially given that strong jobs data lessen the likelihood of a larger rate cut. Q3 earnings season will begin, with major banks like JPMorgan, Wells Fargo, and Bank of New York Mellon reporting on Friday.

Globally, inflation data will be released for Brazil, Mexico, and Russia. In Europe, Germany will report on factory orders, industrial production, and trade, while the Euro Area will release retail sales data. The UK will report on August’s GDP and factory activity, while Canada focuses on unemployment and trade figures. Australia will release business and consumer confidence data, Japan will publish the Reuters Tankan Index, and key interest rate decisions are expected from South Korea, India, and New Zealand.

Levels On Our Radar This Week

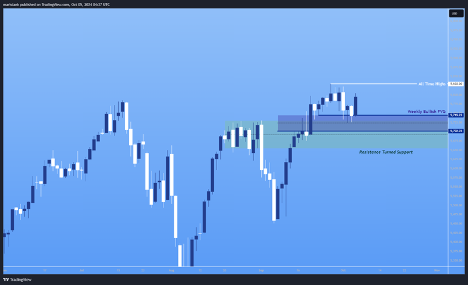

S&P 500

After a strong Friday close and a test and bounce off the weekly bullish FVG we identified last week, the market is signaling the potential for higher prices ahead. However, it’s crucial to remember that the trend is your friend until it’s not. Keep an eye on key levels and watch how price reacts to them, as this can help you spot any potential shifts in direction and when to adjust your bias.

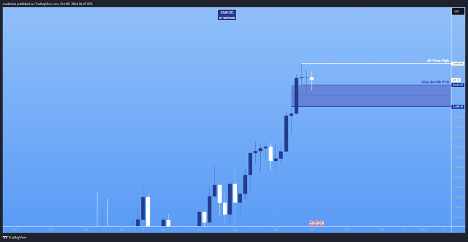

XAUUSD

It’s been an accumulation week for XAUUSD, with the 3-day FVG we highlighted providing solid support for price. As long as this level holds, it supports the outlook for new all-time highs in the near future.

EURUSD

EURUSD, on the other hand, broke its bullish structure, with a clear break of structure to the downside on the weekly chart. We’ll be watching closely to see how price reacts if it tests the 3-day bearish FVG this week. This will help us determine whether the break will continue, leading to further downside, or if it’s just a deep liquidity grab on a higher timeframe.