Reflecting On Last Week

Another Week, Another Record: S&P 500 Hits All-Time High… Again

The S&P 500 set a new all-time high last week, extending its winning streak to six consecutive weeks—the longest of the year. This impressive run has been fueled by strong corporate earnings, particularly from big banks, and growing optimism about the resilience of the U.S. economy.

Nvidia on Track to $4 Trillion Milestone

Nvidia continues its remarkable climb, closing the week at a record high of $138 per share and reaching a market value of $3.39 trillion. With strong demand for its GPU chips, experts now believe Nvidia could become the first Big Tech company to hit a $4 trillion market cap, overtaking Apple.(Yahoo)

Netflix Beats Q3 Expectations, Shares Surge 11%

Netflix saw its stock jump 11% after reporting better-than-expected Q3 earnings. The company posted earnings per share of $5.40, exceeding the $5.12 estimate. Growth in its ad-supported membership tier was a key highlight, rising 35% quarter-over-quarter and accounting for over 50% of new sign-ups. (CNBC)

The Week Ahead: Events to Watch

In the U.S., several high-profile earnings reports are set to be released, with Tesla, Coca-Cola, 3M, GM, and Verizon among the companies unveiling quarterly results. Key economic data, including PMI figures, durable goods orders, and housing reports, will provide insight into the broader economic landscape.

Internationally, investors will closely watch Germany’s business climate index and Eurozone consumer confidence reports. Manufacturing and services PMIs from major global economies will also be in focus. In Canada, the Bank of Canada’s interest rate decision and retail sales figures are key events, while South Korea will release its Q3 GDP data.

Levels On Our Radar This Week:

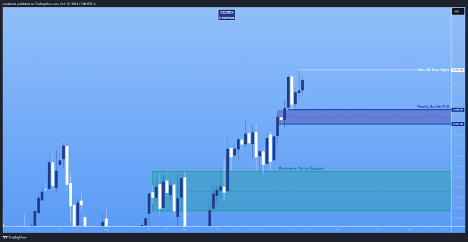

S&P 500

The S&P 500 closed higher for the sixth consecutive week. This rally left a key fair value gap on the weekly timeframe, which could act as a point of interest for price if we see a short-term pullback.

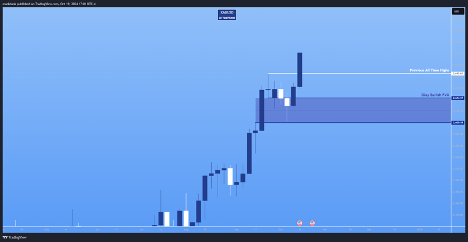

XAU/USD

Gold continues its upward momentum, seemingly on a straight moon shot toward $3,000. If a retrace occurs, we’ll be watching to see if previous all-time highs can act as support for higher prices.

EUR/USD

EUR/USD continued its downward trend last week, with the price holding near a monthly bullish golden pocket. As the pair approaches trendline support, we’re watching for a possible pullback toward the weekly bearish fair value gap in the coming days.