Reflecting On Last Week

Big Tech Leads Nasdaq to Record High

The Nasdaq rallied 1.5% on Friday to a new record high of 18,690.01, surpassing its previous peak set in July, driven by gains from the “magnificent seven” tech giants. Meanwhile, the S&P 500 and Dow Jones Industrial Average saw more modest increases of 0.5% and 0.8%, remaining just below their own recent highs. (CNBC)

Tesla Shares Rocket 23% on Strong Q3 Earnings

Tesla shares surged nearly 23% this week after the company’s earnings report showed an 8% rise in net income for Q3, marking its first profit growth of 2024. Investors were surprised by a projection of “slight growth” in vehicle deliveries for the year, defying expectations of a decline. CEO Elon Musk’s forecast for strong delivery growth in 2025 added to the bullish outlook. (Forbes)

Nvidia vs. Apple: A Tight Race for World’s Highest Valuation

Nvidia and Apple were neck and neck in market value on Friday, with Nvidia briefly topping Apple at $3.53 trillion before closing slightly lower at $3.47 trillion against Apple’s $3.52 trillion. Nvidia’s gains, up 18% this month and 190% this year, reflect the continued demand for its AI chips. Apple, contending with slowing iPhone sales, is due to report quarterly results on Thursday. (Reuters)

The Week Ahead: Events to Watch

This week, U.S. traders should watch for major data releases, including the advance Q3 GDP estimate, non-farm payrolls, unemployment, and PCE inflation. Other key data includes ISM Manufacturing PMI and consumer spending, with earnings reports from major players like Microsoft, Alphabet, Visa, Meta, Apple, Amazon, Tesla, and Exxon Mobil. In Europe, inflation and GDP figures from the Eurozone’s largest economies will draw attention, while Asia’s highlights include China’s PMIs and Japan’s interest rate decision.

Mental Mastery Message of the Week

“If your goal is to trade like a professional and be a consistent winner, then you must start from the premise that the solutions are in your mind and not in the market.”

-Mark Douglas

Levels On Our Radar This Week:

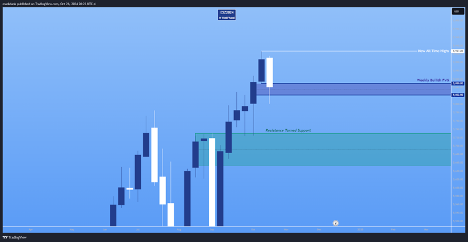

S&P 500

The S&P closed its first bearish week after six consecutive gains, ending within a bullish FVG. We’ll be closely watching price action in this zone for potential buying opportunities.

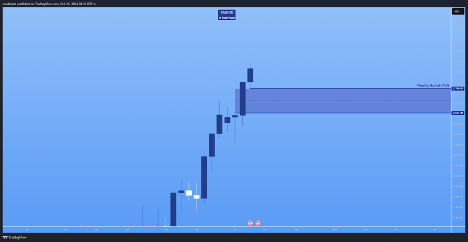

XAU/USD

Gold’s monster bullish trend shows no signs of letting up. We’ll continue targeting dips on lower time frames until a market top becomes evident. This week’s close created a weekly bullish FVG, an area we’ll watch closely for buying opportunities.

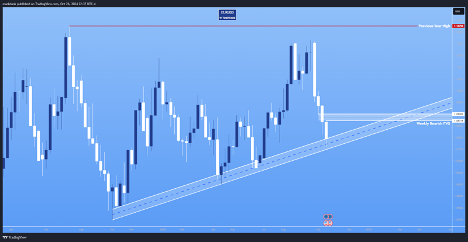

EUR/USD

In contrast, EUR/USD remains under pressure, marking another weekly close in the red and down almost 4% for the month. We’re interested in price action around the recent weekly bearish FVG. The pair is approaching bullish trendline support, where we may see either a bounce toward resistance or a further decline. We’re particularly focused on the recent weekly bearish FVG for signs of continuation.