Reflecting On Last Week

Gold Soars as Fed Cut Looms

Gold prices rose more than 1% to hit a new record all time high on Thursday, helped by expectations of an interest rate cut by the Federal Reserve next week after U.S. data signaled a slowing of the economy. (CNBC)

Stocks Rally on Renewed Hope for Larger Fed Rate Cut

Stocks are rising as the market warms once again to the likelihood of a half-point rate cut by the Fed after virtually writing off the chances of a big pivot in light of recent inflation and jobs data. Traders are now pricing in a 49% chance of a 50 basis point move next week, compared with 15% at one point on Thursday. (Yahoo Finance)

The Week Ahead: Events to Watch

The spotlight this week in the U.S. will be on the Federal Reserve’s interest rate decision, with expectations of a 25 bps cut, though odds for a larger 50 bps reduction have risen above 40%. The Fed will also release updated economic projections, with markets pricing in a full percentage point of easing this year. Key economic data includes retail sales, expected to grow by 0.2% following July’s 1% surge, and industrial production, which likely stalled after a 0.6% drop. Other important releases include the NY Empire State Manufacturing Index, the Philadelphia Fed Manufacturing Index, the current account, and housing indicators such as the NAHB Housing Market Index, building permits, housing starts, and existing home sales. (TradingEconomics)

Levels On Our Radar This Week

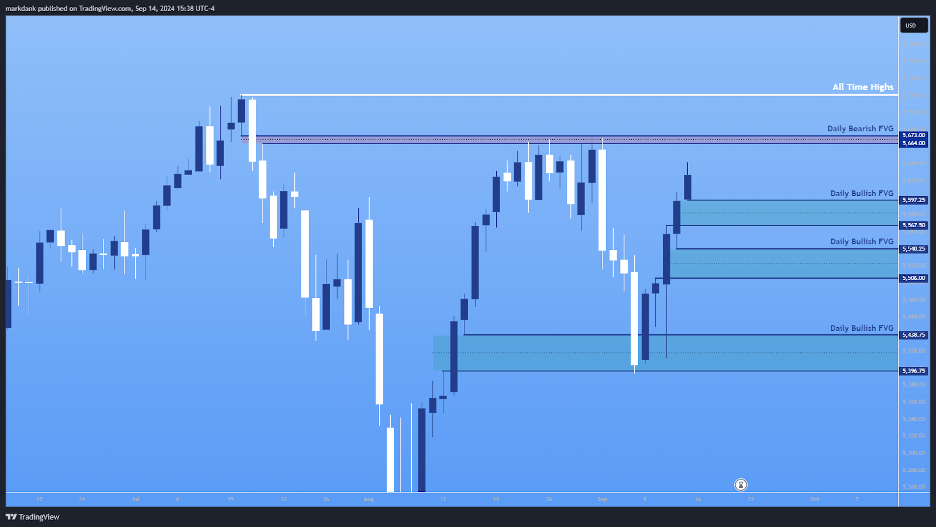

S&P 500

After a strong 5-day rally, the S&P is nearly back to its September open level. The bullish daily FVG we pointed to last week provided support, propelling the price through the bearish daily FVG and closing above it. With equal highs acting as resistance, this week’s FOMC will be key in determining if we see a break higher.

XAUUSD

Gold surges past its previous all-time highs with a strong bull flag breakout, leaving behind a bullish FVG. This week, we’ll keep an eye on that zone to see if it holds as support, especially with Wednesday’s FOMC meeting in focus.

EURUSD

It’s been a relatively lackluster week for EUR/USD, with signs of support holding but also facing rejections at key bearish price patterns. The overall weekly bias remains bullish, as the pair has yet to close below the key weekly support zone but the daily market structure has shifted to short term bearish.