Reflecting On Last Week

S&P500 sets new records

The S&P 500 hit a new all-time high on Friday, closing above 5,800 for the first time in history. The Dow Jones Industrial Average also reached a fresh record, rising nearly 1%, while the Nasdaq Composite gained 0.3%. This marked a strong close to the first full trading week of October, with all major indices posting weekly gains as market momentum continued to build.

Banks lead Q3

Earnings season kicked off with JPMorgan Chase and Wells Fargo, offering insight into how banks are navigating the Fed’s rate cuts. Second-quarter earnings were the second best among S&P 500 sub-industries, with banks notably outperforming the broader index. As a result, bank stocks are up nearly 10% in Q3, with optimism around M&A and investment banking activities, despite concerns about loan growth and interest income.(Bloomberg)

Tesla’s event leaves investors unimpressed

At Tesla’s “We, Robot” event, CEO Elon Musk unveiled the Cybercab, a sleek, silver two-seater without steering wheels or pedals, showcasing Tesla’s vision for an autonomous future. Despite the high expectations, Tesla shares fell nearly 9% on Friday, as the event left investors unimpressed. Analysts voiced their disappointment, with Jefferies releasing a note titled “We, underwhelmed” and Barclays criticizing the lack of near-term opportunities or updates on Full Self-Driving (FSD) progress. (CNBC)

The Week Ahead: Events to Watch

In the U.S., the main focus will be on the retail sales report, expected to rise by 0.3%, alongside speeches from Federal Reserve officials. Traders should also keep an eye on industrial production, housing data, and import/export prices. The earnings season heats up with reports from UnitedHealth, Johnson & Johnson, Bank of America, Abbott, Netflix, and Procter & Gamble.

Internationally, attention will be on the ECB’s interest rate decision, Germany’s ZEW Economic Sentiment, and Euro Area industrial production. The UK will release unemployment, inflation, and retail sales data. China will report Q3 GDP growth, retail sales, and industrial production, while inflation updates are expected from India, Canada, New Zealand, Japan, and South Africa. However, with Monday being a bank holiday for Indigenous Peoples Day, trading activity is expected to be minimal at the start of the week.

Levels On Our Radar This Week:

S&P 500

The S&P 500 has reached new highs yet again. Last week’s support zones held strong, and we are now above all previous highs. In such conditions, it’s often advised to buy high and sell higher. However, with the upcoming election and rising tensions in the Middle East, caution is advised before jumping into the breakout.

The S&P 500 has reached new highs yet again. Last week’s support zones held strong, and we are now above all previous highs. In such conditions, it’s often advised to buy high and sell higher. However, with the upcoming election and rising tensions in the Middle East, caution is advised before jumping into the breakout.

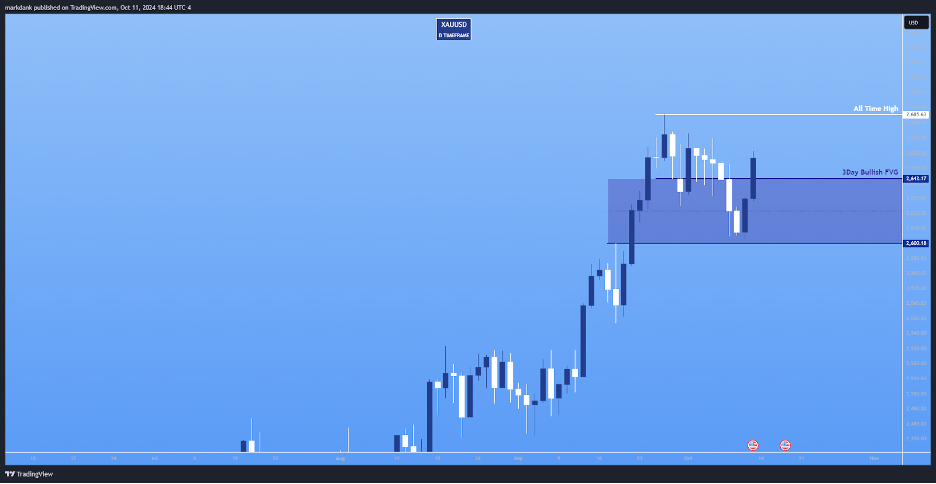

XAUUSD

Gold closed the week with two strong green days, coming out of the bullish zone we identified last week. We’ll be watching this area for continued bullish momentum and the possibility of reaching new all-time highs.

EURUSD

Last week, EURUSD continued its bearish trend without retracing to test previous levels. However, it did tap and bounce from the bullish golden pocket on the monthly price leg. This week, we’ll monitor whether it finally tests the weekly bearish FVG for potential continuation of the downtrend, or if the golden pocket provides further support.